Special Notice

Friday, November 11th is Veterans Day. A national holiday is a common excuse for criminals to target people all across the country, so please tell your veteran loved ones to be alert for scams.

The Federal Trade Commission (FTC) issued a Consumer Alert just days ago reminding veterans that they do not have to pay to file claims. Click the image for details and links to legitimate veteran resources.

1. Neverending Pandemic Scams

Security researchers at email security vendor Inky have spotted a new wave of email attacks using familiar tactics from during the middle of the pandemic.

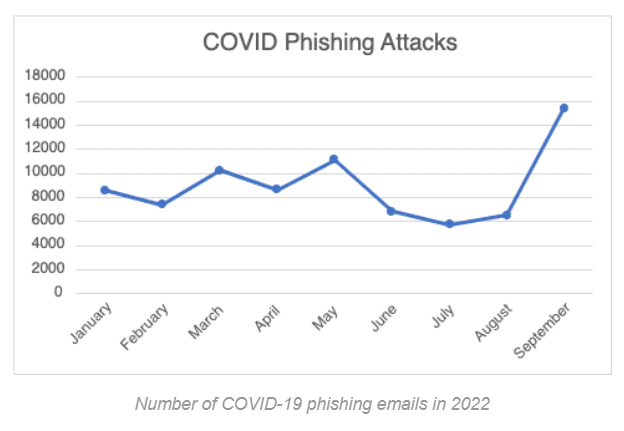

As you can see in the chart to the right, pandemic scams spiked in September of this year. One particularly slippery angle they recently detected combined brand impersonation, credential harvesting, and Google Forms abuse tactics.

Targeting businesses, this one begins as an email claiming to be a grant application from the Small Business Administration (SBA). The email looks real enough and may have text directly copied from legitimate SBA messages.

The Apply Now button takes you to a Google Form that could also be convincing since it has language copied from the real grant application and questions that are very similar to actual questions the SBA asks. However, submitting the form sends all of your information to the criminals.

What can you do to avoid these scams?

As the Inky researchers described above, this scam is slippery because of the effort the criminals put in to copy from the real SBA and the fact that they are using Google Forms, meaning the link is real and shouldn’t trigger email filters.

That said, there are still ways you can determine this is a scam and stay safe.

- Anytime you receive an offer out of the blue, whether for a loan, grant, or surprise winnings, do a little independent research. A couple of clicks on the SBA website would show that they are no longer accepting applications for pandemic relief loans or grants.

- Inky also points out a few grammatical errors in the message and form questions that should alert you to the likelihood that it is a scam.

- With regard to the form itself, always stop yourself before submitting personal information such as SSN, date of birth, or even your driver’s license number unless you are 100% certain it is safe. Often that will only be in a password-protected portal or highly secure system, not a Google Form that anyone can create and share to collect data.

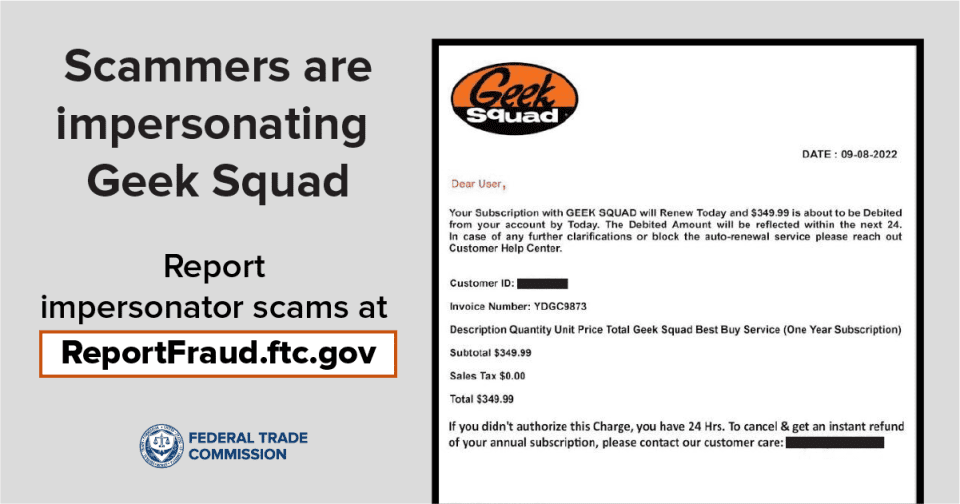

2. Geek Squad Renewal Scam

In another recent alert from the FTC, criminals are impersonating Geek Squad, Best Buy’s tech support service. This scam starts as a text or email, and its goal is to get you to call a number rather than click a link.

The message claims you are about to have a membership renewed for hundreds of dollars unless you call within 24 hours. If you call the number provided, you may be convinced to give the caller remote access into your computer. This won’t remove anything, but it will allow them to install malware or spyware on your machine so they can steal your data.

You may also be asked for your banking information so they can issue you a refund. Instead, they’ll show you a fake transaction that is ‘accidentally’ more than you should have been refunded. Then they’ll ask you to pay the overage in gift cards or other untrackable funds.

How can you protect yourself?

- Don’t be lulled into thinking it’s not a scam just because there isn’t a link to click. Like the Paypa| scam from September or the phone scam statistics I sent in July, taking these attacks offline and over the phone has been growing steadily more popular and successful.

- You can also foil these scammers by looking for the business phone number online, not using the number they include in their message. A call to the real company would clear everything up.

- And remember to always be suspicious of emails or texts that make you feel a sense of urgency. Most legitimate businesses give you ample warning before renewing or changing your paid subscriptions. A message claiming you have to take action immediately or within 24 hours should always raise red flags.

3. Social Security Administration Scam

Security researchers at Inky are also warning us of a recent influx of scams about social security numbers.

They arrive as an email appearing to be from Social_Security_Administration.

“All of the SSA brand impersonation emails INKY caught contained a PDF attachment that opened in the form of a letter with SSA-branded elements. [T]he letter starts with one of SSA’s widely used logos alongside a short tagline. It’s an image that looks sharp and is readily available online. In the body of the letter, the sender claims that illegal & fraudulent activities have been associated with the recipient’s SSN and, as a result, their SSN will be suspended in 24 hours. A phone number is given to resolve this issue.”

The following examples are some of the subject lines that were used to seem authentic (by including ID numbers) and urgent enough to get people to open the messages.

- Hi [redacted_email address] SSN going to be suspended (Case ID- SSA-75214260).

- Hi [redacted_email address] SSN found under suspicious activities, Docket No. 79851704.

- Fraudulent activity detect in your SSN Account.. Case id:15383815

- Suspicious activity detect in your SSN account. Docket id:13161614

- Your SSN id will be discontinued from service due to suspicious activity. Case id:18191915

- Your SSN id shortlisted for intimation. Case id:20101028

Inky explains some of the psychology behind these attacks’ success:

“What do you worry about the most? If you’re like most Americans surveyed on the subject, at the top of your list are money, the future, and political instability. On their own, each of these topics has the power to create a pretty hefty amount of anxiety. Combine them, however, and you have the perfect recipe for mayhem.

We all have reason to worry. The annual rate of inflation is the highest it’s been in 41 years. The Federal Reserve has raised interest rates five times thus far in 2022 – to the highest they have been since 2008. And, an uneasy feeling about Social Security has been brewing for years, with funds expected to be depleted by 2034.”

So how can you stay safe from this?

- A quick visit to the Social Security Administration website shows one of the most common questions they get is about being contacted about a problem with your SSN. The first sentence in their answer says, “If there is a problem, we will mail you a letter.” Along with other information, they remind us that “Caller ID or documents sent by email may look official but they are not.”

- Remember to stop yourself anytime you read an unsolicited message that evokes any kind of emotion, whether that’s fear, anger, etc. Scammers like to make their targets feel emotional so they act quickly, without thinking things through.

- Look carefully at the sender and the language used in the message. Legitimate government email addresses should end in .gov, and professional messages should not have grammar mistakes.

- Always be suspicious of unsolicited messages with attachments. In this case the attachment is not flagged by email filters because it does not have any malicious links in it. The scammers want you to call, not click. But if you dial that number, you’re not calling the official government agency.

- Always search for contact information independently.